When we think of competition in fintech, the eye usually falls on the likes of Paytm, PhonePe, CRED and the likes which dominate consumer payments and UPI. But there’s another intense rivalry brewing in the online merchant payments space, with Razorpay firing a new shot in the battle this week.

Razorpay’s majority stake acquisition in UPI payments app POP adds a new dimension to the competition in the payments aggregator space after the split in the market over payments orchestration earlier in the year.

Let’s unpack what POP brings to Razorpay’s table and whether it can deliver the edge that the Bengaluru-based unicorn is seeking. But first, a look at the top stories from our newsroom this week:

- Matter Of Minutes:Ecommerce major Flipkart takes a cautious bet on its quick commerce venture Minutes to save its revenues and stay relevant. Will this pay off with Dunzo founder Kabeer Biswas leading operations?

- Nykaa Fashion Faux Pas: While Nykaa’s beauty and personal care vertical continues to thrive with strong revenue and GMV growth, its fashion segment has underperformed. Can the listed giant revamp its wardrobe?

- Otipy’s Collapse:Despite raising significant capital, Otipy struggled to sustain operational efficiency and financial viability due to the capital-intensive last-mile delivery model, wafer-thin margins on fresh produce. Here’s how it went bust

It’s been a busy few months for Razorpay. The company completed the reverse flip, merging its US-registered parent entity with its Indian entity and merged its subsidiaries to consolidate operations in the country.

The company is likely to pay approximately INR 1,245 Cr (around $150 Mn) in taxes to the Indian government as part of its reverse flip to the country, as Inc42 reported in May. Razorpay is also targeting an initial public offering (IPO) in the next two years. The fintech unicorn was valued at $7.2 Bn when itlast raised funding of $375 Mn in 2021.

Founded by Harshil Mathur and Shashank Kumar, the Peak XV-backed company has alsoconverted into a public company. The startup has raised over $740 Mn and counts the likes of GIC, Tiger Global,and Lightspeed Ventures among its investors.

In a bid to save on some of the tax outlay, Razorpay’s US-registered parent entity decided to bring its six India units under a single local holding company, Razorpay Software India, as part of its restructuring exercise.

Over the past five years — particularly in light of the post-Covid transformation among SMBs and merchants — Razorpay has gone from a payments gateway to an omnichannel banking and digital payments platform covering everything from payroll management, banking, lending, payments, insurance among others over the years.

Vertical Build-UpIn the early days of digital commerce, around 2015 and 2016, payment gateway were vital partners for marketplaces and online stores, but over the past eight years, there has been a rapid evolution.

The first phase of the evolution saw payment aggregators come into the picture, which collected payments from users and settled them en-masse with merchants and marketplaces, rather than processing each payment individually.

Razorpay entered the PA space with in-principle approval from the RBI, but in December 2022, the RBI banned companies from onboarding new users before getting full approval. This threw a spanner in Razorpay’s well-built machine.

In some ways, this could be seen as a blessing, because even the commerce ecosystem — particularly Razorpay’s D2C brand partners — was moving from online-first to omnichannel mode. Today, the payment aggregator (PA) business is the mainstay for Razorpay. Today, Razorpay claims to have more than 5 Mn businesses on board.

The company has built solutions for the wider ecosystem too, catering to problems such as tracking fraudulent ecommerce orders using customer insights, payroll disbursement, offline payments as well as cross-border payments.

On the financial side, Razorpayreported a consolidated net profit of INR 33.5 Cr in the fiscal year ended March 31, 2024 (FY24), a 365% jump from INR 7.2 Cr it reported in the previous year. Meanwhile, the operating revenue rose by 9% to INR 2,475 Cr for the period under review against INR 2,283 Cr in FY23.

Competition BrewsThe online payments ecosystem has become an intense battlefield with more than two dozen payments aggregators joining the mix since 2024. Naturally, the likes of Cashfree and Razorpay want to protect their early leads in this space and avoid the situation which derailed Instamojo. Even UPI leaders like PhonePe have jumped into the battle and have armed themselves with a PA licence.

But this broadening of the market led to each company retreating into their walled gardens. What used to be a payments market that was open for competition has become one where many are growing insular.

The first big move was the payments orchestration mess in January, which saw PhonePe, Razorpay and Cashfree Payments pausing integrations with third-party payment orchestration platforms, which were creating a more level playing field.

Both Cashfree and Razorpay said it would stop working with other players which offered payments orchestrations and use its own solution. Cashfree introduced ‘Flowise’ to the market in 2024, while Razorpay matched it with ‘Optimizer’.

“Going forward, we will pause all integrations through third-party routing platforms. We will offer payment gateway services directly to our customers, ensuring our latest innovations reach them swiftly and enhance their operations seamlessly,” Razorpay said in a statement in January.

The move was seen as the first big shot, even though the primary target was JusPay. JusPay claimed the move impacted about 40% of the company’s revenue.

The primary contention for the likes of Razorpay and Cashfree was that JusPay was acting as more than an orchestration platform and offering merchants services like routing, reconciliation, OTP reading, authentication and token generation and looked to upsell these services to merchants.

Razorpay, as we showed above, is more than just a payments aggregator and this directly competes with its own suite of offerings. Naturally, the companies pulled up the walls around their offerings and cut off third parties.

When viewed in this light, the investment and majority acquisition of POP seems like a way for Razorpay to make its walled garden a little more attractive for merchants.

Where Does POP Fit In?Launched in 2023 by ex-Flipkart executive Bhargav Errangi, POP is an UPI payments app, an integrated marketplace, and offers a co-branded credit card that helps users rack up POPcoins.

Much like CRED Coins, these POPcoins are earned on every UPI transaction and can be redeemed for products from leading D2C brands across beauty, electronics, fashion and home, making everyday payments more rewarding than ever.

“POPcoins are designed to build habits, increase retention, and reduce CAC for merchants – all while making payments more rewarding for the end user. With Razorpay’s support, we will double down on our mission to bring a loyalty-first payments ecosystem that will help businesses scale with purpose, speed, and impact,” said Bhargav Errangi, founder of POP.

Since launch, POP claims to have scaled to over 6 Lakh daily UPI transactions, 1 Mn monthly active transactors, 2 Lakh monthly commerce shipments and 40,000 RuPay credit cards issued in partnership with Yes Bank.

By backing POP, Razorpay will be able to offer D2C merchants more than just transaction infrastructure, it is looking to provide tools that foster customer trust, boost repeat purchases, and build long-term brand loyalty.

This move also complements Razorpay’s acquisition of PoshVine in 2022, when it began offering loyalty and rewards management services to its merchants. Eventually, this laid the foundation for Razorpay Engage, a full-stack intelligent marketing growth suite.

Razorpay CEO Mathur believes the investment in POP is driven by the purpose of serving D2C merchants better. “In today’s crowded D2C space, brands need more than just payment solutions, they need tools to earn trust, drive repeat purchases, and build real loyalty. POP bridges that gap by combining instant rewards, seamless payments, and brand discovery in one platform,” Mathur said.

Branching out into digital commerce is a logical extension for Razorpay. It’s not just about India. In March 2025, two years afterlaunching its operations in Malaysia, Razorpay ventured into Singapore

The company’s cross border transactions, payment gateway and real time financial analytics are already available in Singapore and it will now look to closely work with the financial institutions, banks and regulatory bodies of the country. Like fellow IPO-bound company Pine Labs, Razorpay could be looking at loyalty services as an unlocker in the Southeast Asian market.

Razorpay has the lead in the payments aggregator space, but adding to this lead is a vital step for the company as it looks at life after the public listing.

POP may not seem like a major move at the moment, but it offers a lot of possibilities for Razorpay in the long run. The $30 Mn infusion is relatively small, but it will give POP enough ammunition to increase its UPI market share in the medium term and Razorpay would be banking on that to truly prove the proposition to merchants

Sunday Roundup: Startup Funding, Deals & More

- Apple’s AI Bet:Apple is reportedly exploring a potential acquisition of Aravind Srinivas-cofounded Perplexity AI to boost its artificial intelligence capabilities and compete with the might of OpenAI and Google’s Gemini

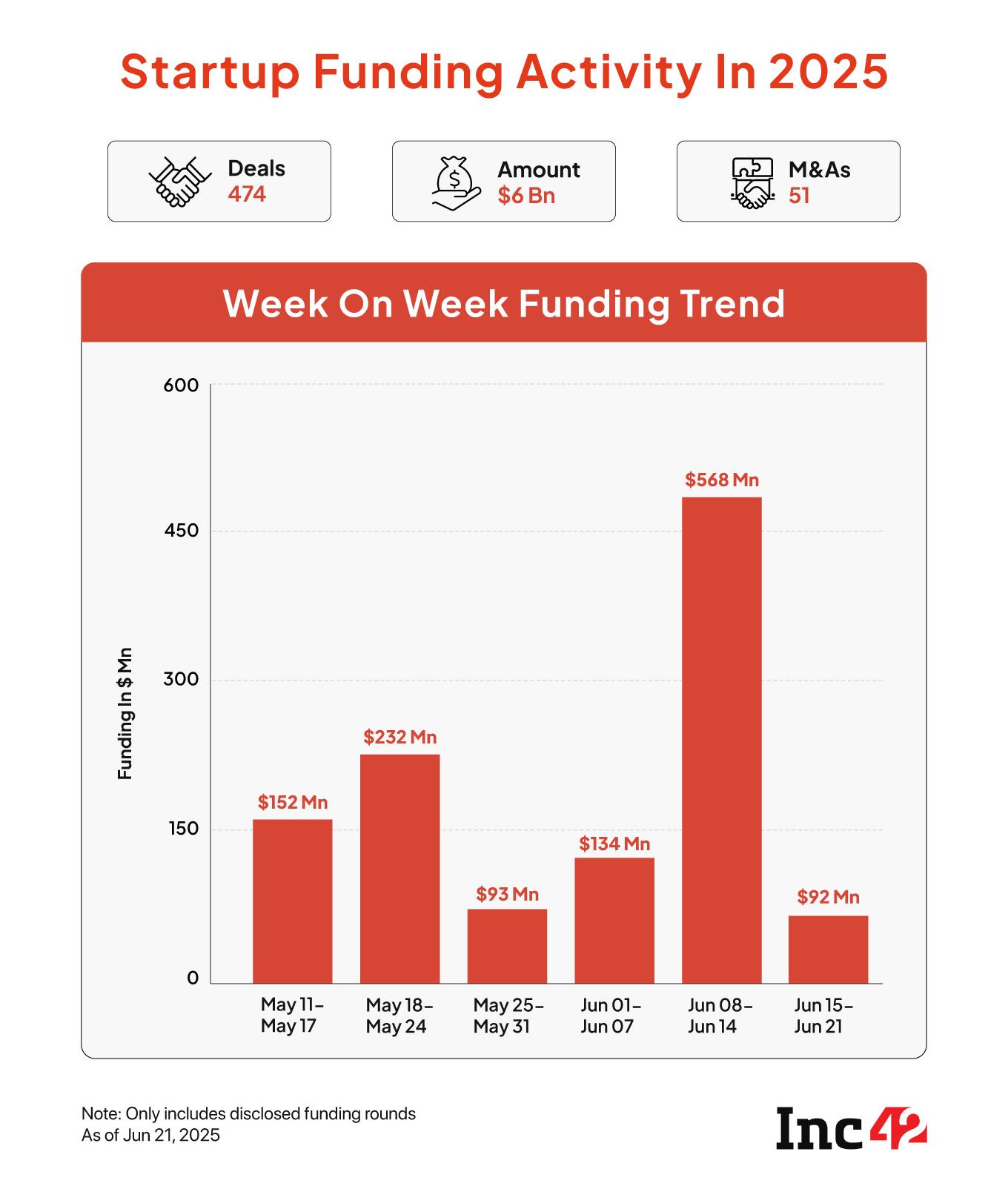

- Funding Falls:After gaining ground, investment activity in the Indian startup ecosystem plunged in the third week of June. Between June 16 and 21, startups raised $91.5 Mn across 10 deals, down 84% from the previous week

- District Expands: Deepinder Goyal-led Eternal has silently launched listings of retail stores and chains on its ‘Going Out’ business app, District. The new ‘Stores’ section on the app allows users to locate stores dealing in apparel, footwear, accessories, home decor, and more

- Myntra’s Move:After Bengaluru, fashion ecommerce giant Myntra has expanded its quick delivery service M-Now to Delhi NCR and Mumbai bringing deliveries within 30 minutes

The post Why Razorpay Added POP Music To Its ‘Paylist’ appeared first on Inc42 Media.