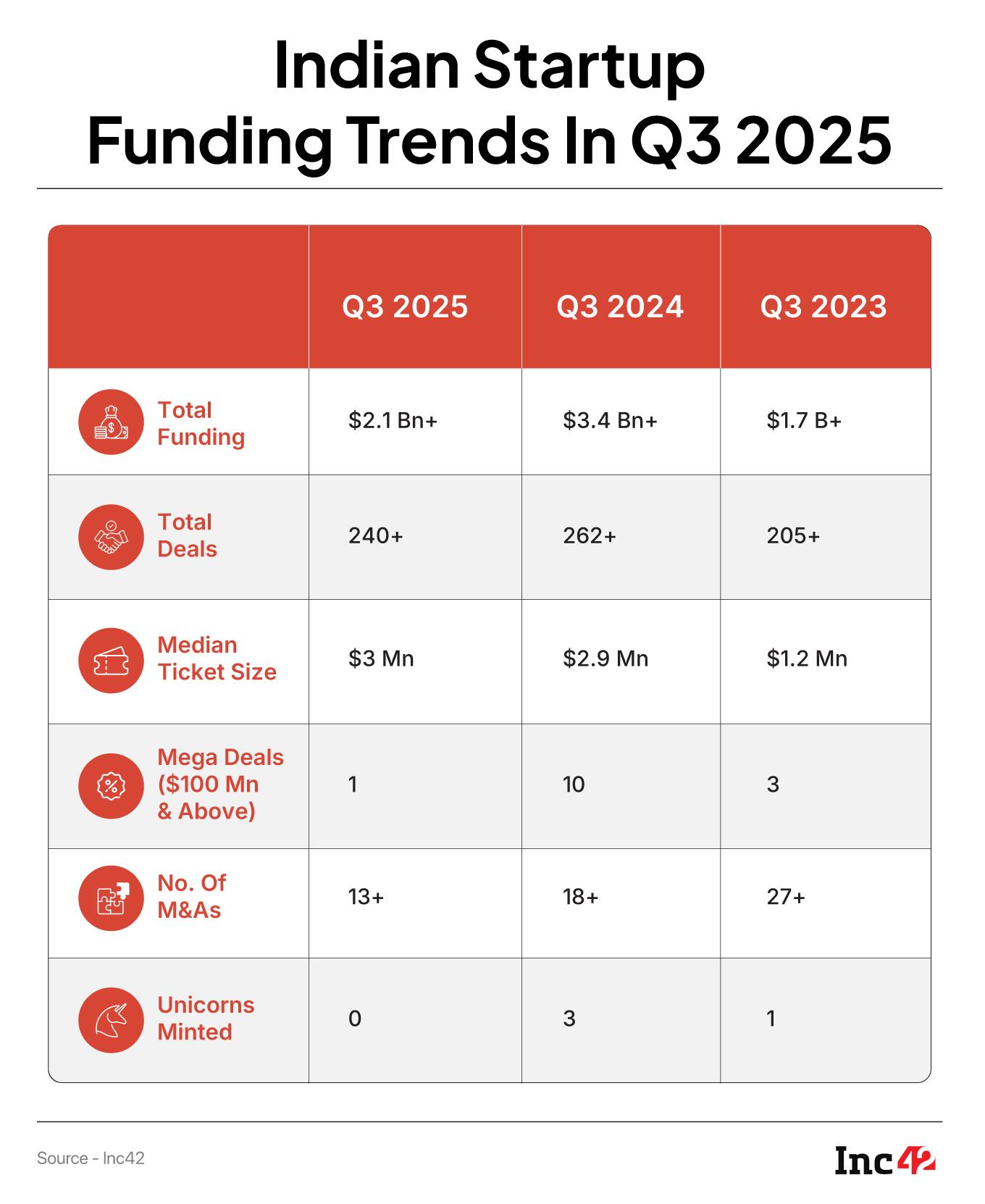

Indian startup funding took a downturn in the third quarter of 2025, with total funding declining 38% YoY to $2.1 Bn. As per Inc42’s “Indian Tech Startup Funding Report, Q3 2025”, total deals also declined to 240 deals from 262 deals between July 1 and September 28, 2025.

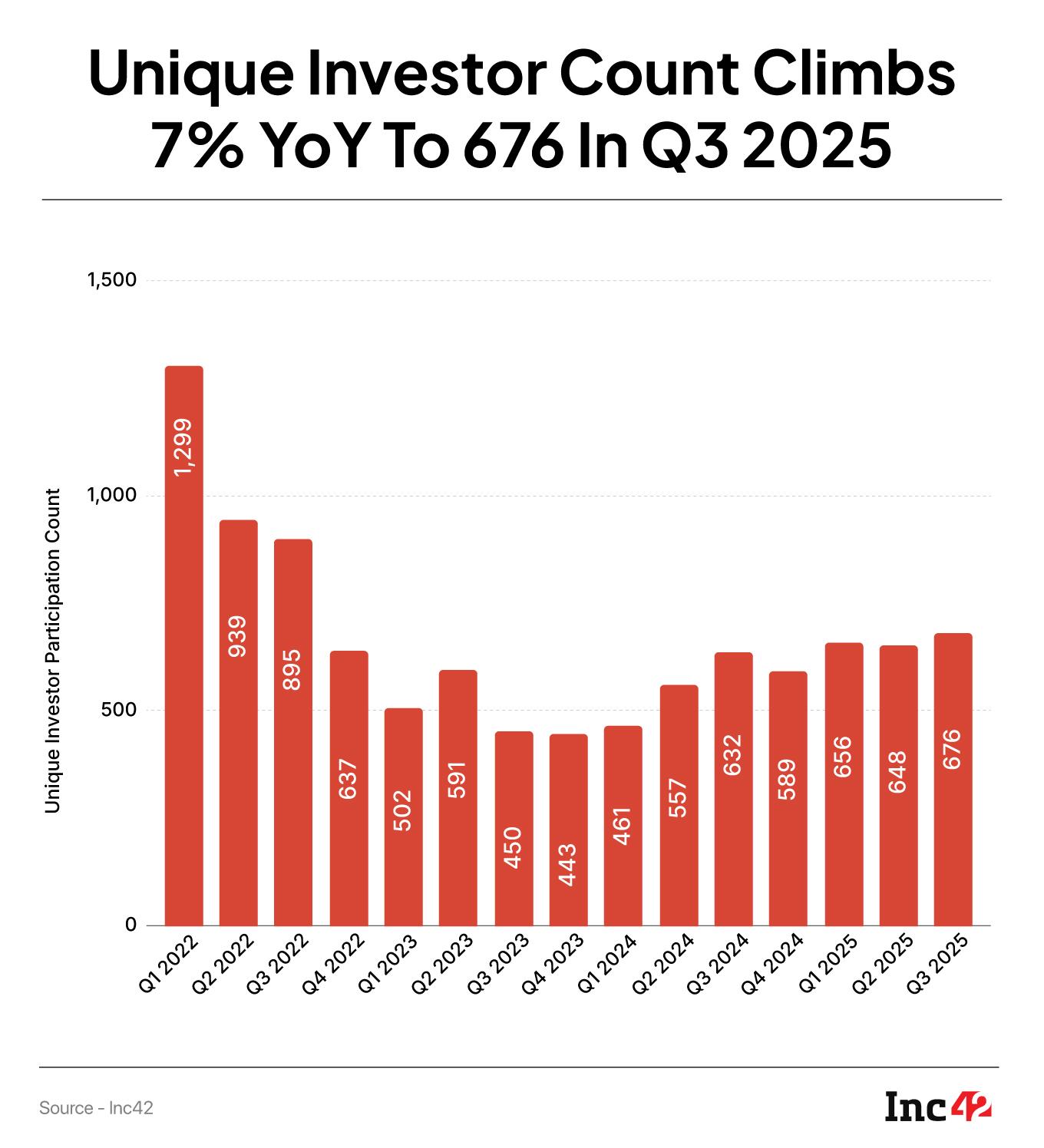

However, there seems to be a silver lining emerging amid this lull. As per the report, unique investor participation in backing Indian startups rose 7% YoY and 4% QoQ to 676 in the quarter. Besides, the average deal size also edged up slightly to $3 Mn from $2.9 Mn a year earlier.

Further, the dip in funds allocated in Q3 2025, which was seen across startup sectors, came at a time when we saw more venture capital (VC) firms launch new funding vehicles or raise fresh capital in their pre-existing funds.

Here are a few key updates on fund related developments that happened in the quarter:

- Deeptech focussed VC firm Speciale Invest closed its third fund raising INR 600 Cr. The fund was oversubscribed 20% from the initially planned INR 500 Cr.

- Rajesh Mane and Ankit Jain launched their new VC firm Spotlight Strategic Partners with a maiden early-stage focused fund with a corpus of INR 200 Cr.

- Early stage investor Kettleborough VClaunched its second fund with a target corpus of INR 80 Cr and marked the first close of the fund at INR 35 Cr.

- Atomic Capital announced the final close of its maiden fund at INR 400 Cr.

With funds worth $2.5 Bn launched in the quarter, investors have launched funds worth over $9 Bn in the first nine months of 2025, surpassing the $8.7 Bn number of 2024.

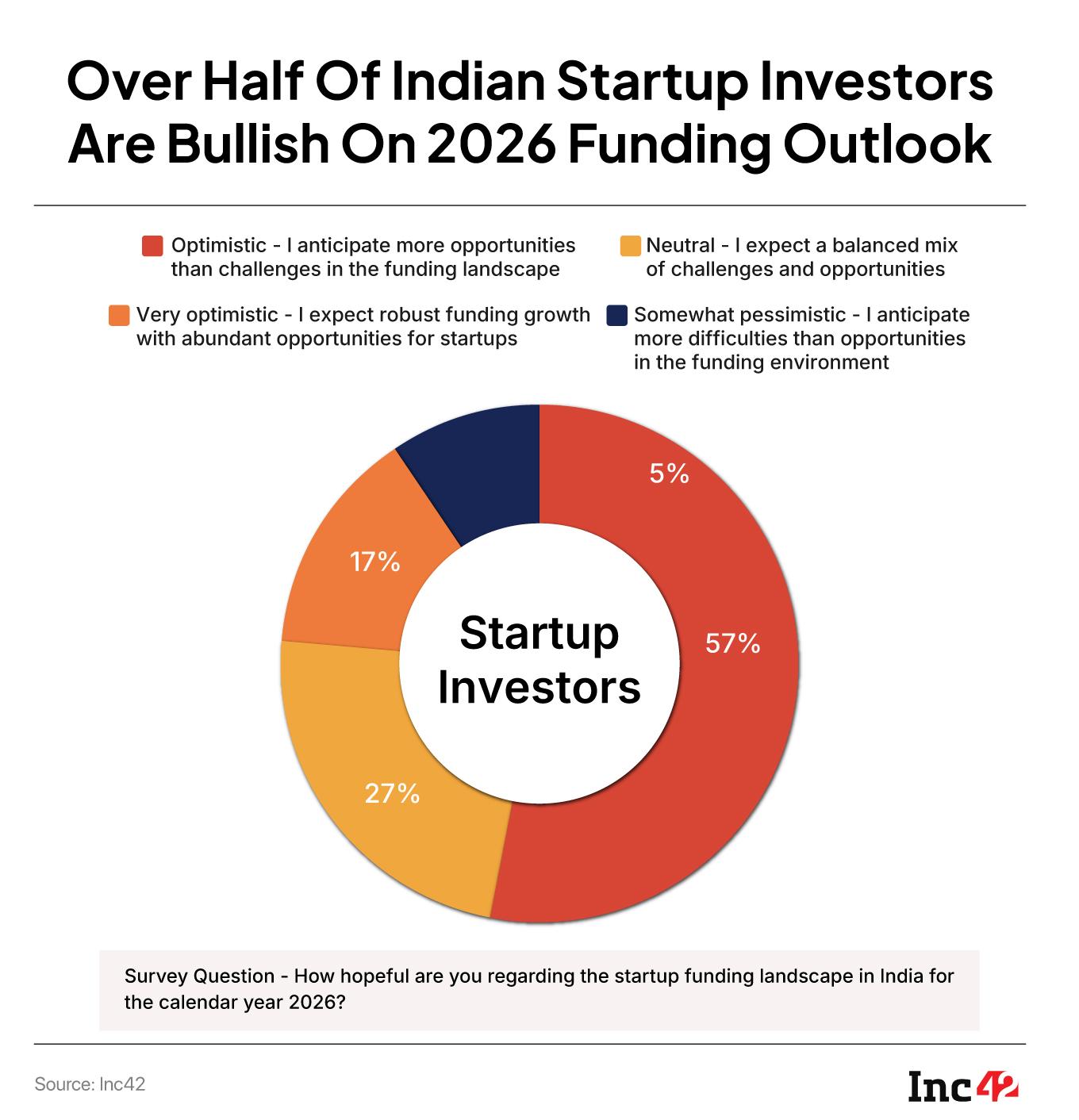

With VCs accruing more dry powder in the quarter, more than half of startup investors believe that the upcoming calendar year would see startup funding pick up in India, As per Inc42’s investor pulse survey, about 51% of over 80 surveyed investors expect more opportunities in the coming year, though 27% remain wary amid global uncertainties and US-India trade frictions.

As for Q3, the investment landscape continued to be dominated by the usual suspects. While venture debt firm Stride Ventures continued to tower over the roster of investors in terms of the total cheques signed, new investments of VC firms like Peak XV, Accel, Blume VC, among others frequently made headlines.

With that, here’s an update on what the quarter looked like for top Indian startup investors.

| Investor Name | Type | Deal Count | Notable Funded Startups |

| Stride Ventures | Venture Debt | 34 | One Assist, Zetwerk, Infra.Market, SUGAR Cosmetics |

| Rainmatter | Venture Capital | 16 | Capitalmind, Rupeeflo, Krop AI, Boldcare, P-Tal |

| Innoven Capital | Venture Debt | 13 | Rebel Foods, Cashfree, Bharatpe, Stanza Living |

| Ah Ventures Fund | Venture Capital | 13 | Ochre Spirits, Bharatsure, SnapE Cabs |

| Inflection Point Ventures | Venture Capital | 12 | Samaaro, Snap-E Cabs, Qurex, Xovian Aerospace, Uravu Labs |

| Antler | Venture Capital | 12 | AIGnosis, Aspera, XTCY, Nugen, Pascal AI Labs |

| Peak XV Partners + SURGE | Venture Capital | 11 | OnFinance AI, WizCommerce, Truemeds, Pristyn Care, ELIVAAS |

| Accel | Venture Capital | 10 | Vedantu, Rocket AI, Infra.Market, FirstClub, CityMall |

| Swadharma Source Ventures | Family Office & Funds | 10 | OnFinance, troovy, thermoflyde |

| All In Capital | Venture Capital | 10 | Mello, Superliving, Magma |

| Blume Ventures | Venture Capital | 9 | Ozzy, Lucira, Power Up, Vutto, FirstClub |

| Titan Capital | Venture Capital | 8 | Hiezen, Cherry, Naturik, Peeko, Homerun, Confido, Circle, Sookti AI |

| IAN Group | Angel Network/ Fund | 8 | Chakr Innovation, Harajuku Tokyo Cafe, Manastu Space, OnFinance AI |

| Unicorn India Ventures | Venture Capital | 7 | Zealthix, Deep Algorithm, Kluisz |

| Venture Catalysts++ | Accelerator & Incubator | 7 | Paar Autonomy, SpaceFields, Vaani AI Research, P-TAL |

| Huddle Ventures | Venture Capital | 7 | CuminCo, Asaya, Littlebox |

| Sucseed Indovation Fund | Venture Capital | 6 | We360.ai, Samaaro, BIVA.ai |

| Elevation Capital | Venture Capital | 6 | Presolv360, Seekho, AppsForBharat, Jeh Aerospace |

| Z47 | Venture Capital | 6 | Oolka, WizCommerce, Dashtoon, Scalekit |

| Kae Capital | Venture Capital | 6 | KNOT, Eternz, Cartesian |

| RTP Global | Venture Capital | 6 | FirstClub, Tuco Kids, Vutto, Kluisz.ai |

| GVFL | Venture Capital | 6 | Biokraft Foods, Brandworks Technologies, Genexis Biotech, QRL Bioscience |

| LVX (LetsVenture) | Angel Network/Platform | 6 | AkashaLabdhi, FarmDidi, Harajuku Tokyo Cafe, The Wedding Company |

| DeVC | Venture Capital | 5 | VyomIC, Navo, Terafac, Grexa AI |

| General Catalyst | Venture Capital | 5 | Pronto, Jeh Aerospace, Stan, Chai Bisket |

| OTP Ventures | Venture Capital | 5 | Phab, Liquide, hoop, Asaya |

| Piper Serica | Venture Capital | 5 | Inbound Aerospace, Xovian Aerospace, Contineu AI |

| Orios Venture Partners | Venture Capital | 5 | Hexa, Scrap Uncle, Grip |

| 100X.VC | Venture Capital | 5 | Fery Rides, Contrails.ai Harajuku Tokyo Café |

| Anicut Capital | Venture Capital | 5 | Blue Tokai Coffee Roasters, P-TAL, SUGAR Cosmetics, SuperZop, Unico |

| India Accelerator | Accelerator & Incubator | 5 | Ammunic, Zulu, Spotsense, Recur Club, Indrajaal |

| Nexus Venture Partners | Venture Capital | 5 | Metaforms, Infra.Market, Mitigata, Kiwi |

| Source: Inc42 | |||

| Note: This ranking is based on data consolidated from Inc42’s India’s Top Startup Investor Ranking Survey [Q3 2025 Edition], and deals recorded in the Inc42 database. |

After writing the highest number of cheques in the first half of the year, the venture debt firm again claimed the top spot in Q3 FY25. This quarter, the Ishpreet Gandhi-led firm backed 34 startups, including One Assist, Zetwerk, Infra.Market, SUGAR Cosmetics, among others.

Besides its focus on the Indian startup ecosystem, Stride also forayed into the Middle East market Arabia in September 2025. As per a Bloomberg report, the firm plans to deploy $200 Mn in the country’s business ecosystem in the coming two years.

The firm announced the first close of its Abu Dhabi Global Market (ADGM) Fund V in July to provide flexible capital to high-growth startups across the region as per local customs and laws.

Rainmatter By ZerodhaRainmatter clocked 16 investments, securing the spot of second most active investor in Q3 FY25. Some of its notable deals include Capitalmind, Rupeeflo, Krop AI, Boldcare, and P-Tal.

The Zerodha-backed firm launched its perpetual fund with INR 1,000 Cr in 2023. As per a report by MoneyControl, the VC firm added an additional corpus of INR 1,000 Cr in June. It has plans to deploy the capital over the next two-three years, primarily in fintech, climate, and health sectors.

InnoVen CapitalTaking the third spot, venture debt firm InnoVen Capital made 13 investments in Q3 FY25. Some of its investments during the period include Rebel Foods, Cashfree, BharatPe, and Stanza Living.

Innoven has doubled down on mature venture debt investments over the years, extending debt financing options to IPO-bound startups like Rebel Foods (participating in its INR 150 Cr debt raise in September) and BharatPe (INR 85 Cr debt round in July 2024).

ah! VenturesAt the fourth spot for Q3 2025, ah! Ventures invested in 13 startups including the likes of Ochre Spirits, Bharatsure, and SnapE Cabs.

As of now, its portfolio startup Zappfresh is expected to get listed on the bourses soon after closing its BSE SME IPO on September 6. The firm invested INR 30 Cr in Zappfresh in 2023 and won’t be selling its shares in the company’s IPO.

Inflection Point VenturesInflection Point Ventures (IPV) struck 12 deals in Q3 FY25, funding startups such as Samaaro, Snap-E Cabs, Qurex, and Xovian Aerospace.

The firm launched a $110 Mn category I angel fund registered under GIFT City’s International Financial Services Centres Authority framework to support early to Pre-Series A stage startups across Indian and global markets.

In the quarter, the debt firm doubled down on its investment in IPO-bound Rebel Foods, participating in its INR 150 Cr funding round.

Not all was smooth for IPV in the quarter though as its portfolio company, ride-hailing startup MyPickup shut its operations, citing challenges in achieving right product-market fit.

Antler IndiaAntler India’s investment strategy in the third quarter revolved around doubling down on its AI portfolio. Antler invested in 12 startups including AI startups like AIGnosis, Nugen and Pascal AI Labs.

Besides its investments, Antler India also launched an AI residency program in August, with an aim to invest INR 4 Cr ($470K) in initial investment in the startups selected for the residency. The residency program also sees it extend $1 Mn in AI-relevant perks along with a potential to invest up to $30 Mn in follow-on investments.

Peak XV PartnersPeak XV Partners made 11 investments including bets on OnFinance AI, WizCommerce, Truemeds, Pristyn Care, and ELIVAAS.

Besides, the VC firm also launched the eleventh cohort of its accelerator and incubation programme, Surge in September. More than half of the startups featured in the cohort of 23 selected businesses hail from India.

Amid its high investment activity, Peak XV continued to see a host of its top deck executives exit the company. MD Harshjit Sethi, CPO Anuj Sahai and human capital director Anirudh Bose Mullick exited the firm in the quarter taking the total count of top deck exits at Peak XV in the past year to nine.

AccelAccel made 10 investments in Q3 , including startups like Vedantu, Rocket AI, Infra.Market, FirstClub, and CityMall.

Besides making early stage bets, the firm also realised hefty returns from the IPOs of its portfolio companies Urban Company and BlueStone. While it netted 27X returns by selling 390 Cr shares in Urban Company, the VC firm saw a windfall of INR 134.7 Cr from BlueStone’s IPO.

Swadharma Source VenturesSwadharma Source Ventures closed 10 deals in Q3 FY25, with notable investments including OnFinance AI, Troovy, and Thermoflyde.

Founded in 2016 by ex-Meta startup programs lead Shrishti Sahu, SSV is the single family office of The Sahu Group, and invests across asset classes including pre-seed to Series A startups, public markets (India & US), fixed income, real estate, among others.

It claims to have disbursed over $30 Mn in capital across 40 startups including STAGE, OnFinance, Jar, Chingari, among others.

All In CapitalAll In Capital made 10 investments in Q3 FY25, backing startups such as Mello, Superliving, and Magma. The VC firm made 14 investments in the first half of the calendar year, taking its total investment count for 2025 to 24.

The firm launched its second fund with a corpus of INR 200 Cr in March and marked the first close of the fund in the same month. Via the fund, it planned on investing in 50 startups in the next three years, with individual funding of INR 5 Cr or less. As for September, the VC was planning to close the fund by the end of 2025.

[Edited by Akshit Pushkarna]

The post Meet The 10 Most Active Startup Investors Of Q3 2025 appeared first on Inc42 Media.

You may also like

NJ 'stalker, killer' Vincent Battiloro is a Charlie Kirk fan, ranted against two girls on livestream before killing them in road rage

Killer Paul Mosley jailed for manslaughter of six children in house fire dies

Bihar polls: No SIRround sound; Election Commission silent on number of 'aliens' deleted

SC rejects Tamil Nadu minister Senthil Balaji's plea in money laundering case

Eight arrested in connection with Cuttack violence, bandh underway amid heavy security