“We have the super power to do things which we could not have imagined earlier,” Lenskart founder Peyush Bansal said last week at an industry event, explaining the eyewear giant’s strategy around AI, acquisitions and building tech capabilities.

That super power, the CEO said, is the foundation that Lenskart has built over the years in terms of supply chain, channel strategy, manufacturing and a lot more.

Indeed, no one can deny that Lenskart has not changed how Indians buy eyewear and spectacles, but now the unicorn is eyeing something else.

Lenskart is set to announce a foray into the smart glasses space next week, through a partnership with semiconductor giant Qualcomm, sources aware of the matter revealed.

The collaboration will likely be announced at Qualcomm’s XR Day event in Delhi on July 21, signalling a major push by the Delhi NCR-based startup into the smart glass segment after testing the waters earlier this year.

Insiders told Inc42 that the next phase for Bansal and Lenskart is making a bid for one of the hottest tech product categories in the world.

Questions sent to Lenskart didn’t elicit any response at the time of publishing this story.

The biggest tech companies on the planet and eyewear giants are collaborating to launch smartglasses and Extended Reality (XR) devices. Even though Lenskart’s smart glasses are unlikely to directly compete with Apple Vision Pro or any other devices with heads-up displays, such as the Meta Quest 3, it signals that the SoftBank-backed company is changing its DNA for the next phase of its journey.

Inside Lenskart’s Smart Glasses ProjectKnown over the course of the past 15 years for its dominance in prescription eyeglasses and sunglasses, Lenskart now sees itself as a serious player in wearable technology and consumer electronics.

This is not an overnight change; Lenskart is said to have been working on this product category for more than a year.

As per sources close to the company, Lenskart will also be partnering with at least two more tech giants besides Qualcomm in the coming months to push forward. The eyewear maker will leverage Qualcomm’s chips and spatial computing expertise for its second-gen smart glasses.

In January 2025, Lenskart launched Phonic, its first pair of smart glasses which brought Bluetooth connectivity, access to AI assistants and discreet on-board speakers. Incidentally, Phonic was positioned as a first generation pair of smart glasses by Lenskart, so it’s likely that the new range of smart glasses will carry the same branding.

The Phonic launch was soon followed by Lenskart’s investment in Thane-based Ajna Lens, a deeptech startup specialising in extended reality (XR) and AI-powered wearable tech. The 11-year-old startup’s flagship product is named Ajna XR Pro, an XR headset, which has support for Windows and Android apps.

At the time, Bansal said in a statement, “This investment marks the next chapter in our smart glass journey. Our partnership with Ajna Lens strategically positions us to accelerate product innovation in this space.”

Now, sources say Lenskart will integrate Ajna’s extended reality tech and software into its smart glasses, including support for AI tools and spatial computing capabilities.

The investment in Ajna Lens gives IPO-bound Lenskart a credible tech foundation to add to its supply chain and operational expertise in the eyewear space. The company’s high market share in the organised retail eyewear category is another strength area when it comes to introducing new products in the market.

Can Lenskart Revamp Itself?The big challenge for Lenskart will be changing its core DNA from a spectacles maker to become a full-fledged consumer electronics company. Will this transition actually work out or is Lenskart swimming in uncharted waters with huge threats on the horizon in the form of Apple, Google, Samsung, Xiaomi and others eyeing the smart glasses space?

One must note that Bansal always wanted to do more than glasses. Before Lenskart became a household name in spectacles, Bansal tried to launch vertical marketplaces for watches (WatchKart), bags (BagKart), and even JewelKart to sell jewellery. None of these quite worked out, leaving Lenskart as the founder’s sole focus.

Now, more than a decade later, the startup’s foray into smart eyewear is expected to add more revenue momentum. Indeed, the company’s revenue model has come under some scrutiny in recent times including legal challenges from Lenskart franchise owners.

Lenskart’s strategy was to launch a house of brands in the prescription eyewear space backed by a massive retail presence. It started with an affordable range of glasses under Vincent Chase and then in 2017, the company launched John Jacobs to enter the premium eyewear segment. This was followed by Aqua lens in 2018, a private label contact lens brand, and multiple other brands to cater to other segments such as Hooper for kids and Lenskart Air.

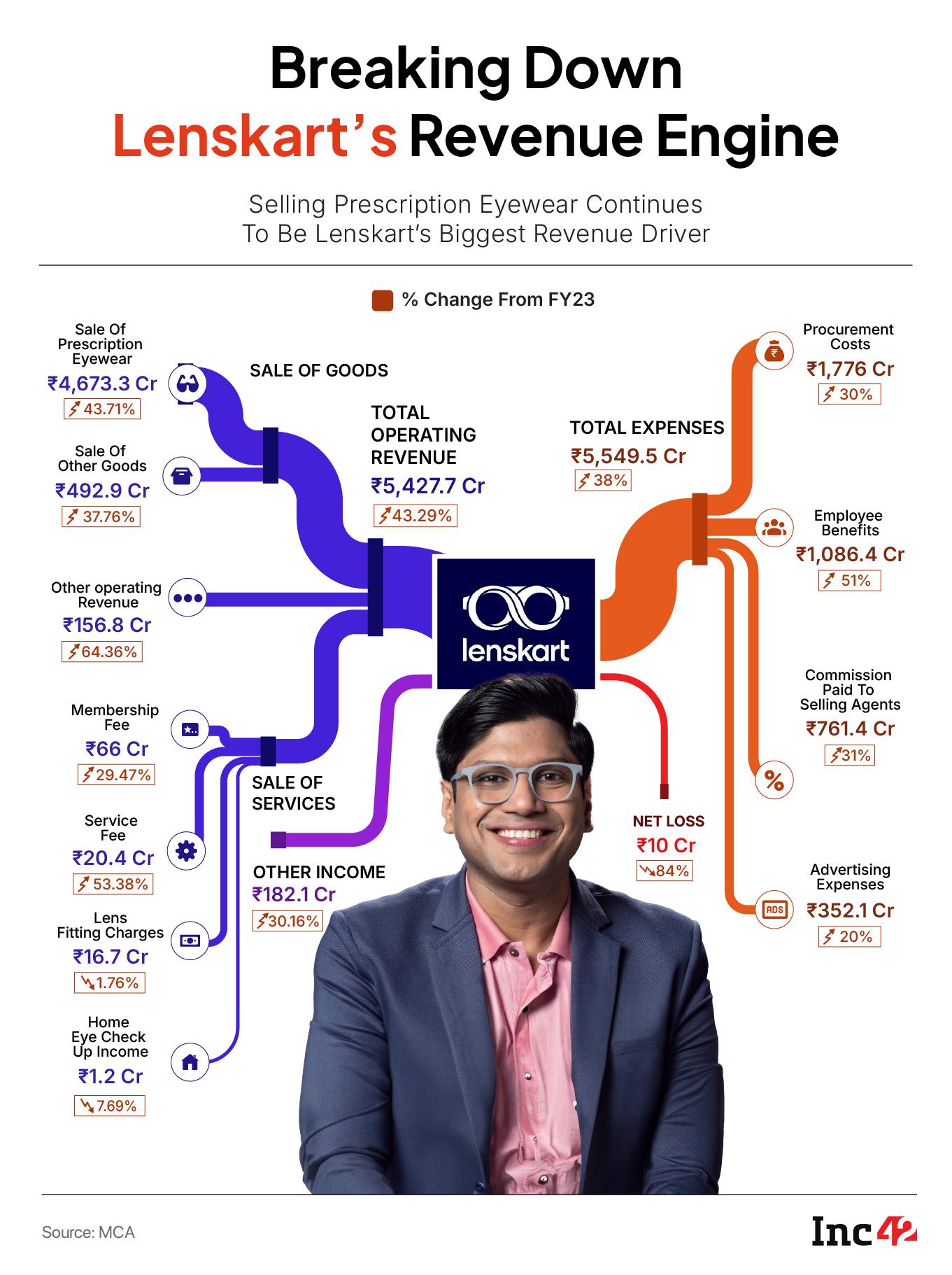

More recently, the company turned to acquiring international brands such as Japan’s Owndays and France-based Le Petit Lunetier in 2022 to take its house of brands strategy to the next level. These international acquisitions contributed INR 2,273 Cr in overseas topline, 43% of the overall revenue in FY24.

From the point of view of channels, besides its app and website, Lenskart’s revenue is driven by retail expansion and adding more stores to push these owned brands.

From the point of view of channels, besides its app and website, Lenskart’s revenue is driven by retail expansion and adding more stores to push these owned brands.

From one retail store in 2010 to over 2,000 stores across 120 cities today, Lenskart has made a push unlike any other ecommerce brand to increase retail presence and visibility. Many of these stores are owned by franchise partners licensing the Lenskart brand name and leveraging its supply chain.

Besides directly acquiring brands, Lenskart did make strategic acquisitions for tech — Tango Eye, an artificial intelligence-based computer vision startup and retail tech startup GenIQ. These helped Lenskart add features such as online try-ons and improve the in-store experience as well.

Despite its revenue scale and penetration in the organised market, one could say that Lenskart’s growth was limited due to how dependent it was on adding more brands and stores. There was something missing, and smart glasses are seen as a way to fill this gap.

Why Smart Glasses?Even though Lenskart was one of the first players in this space, it’s no longer alone. Titan Eye Plus, Specsmakers, Himalayan Eye Wear, or Dayal Opticals are emerging as credible competition in addition to brands such as Coco Leni, Sam & Marshall and others.

It would not be wrong to say that over the years Lenskart’s primary strategy to outgrow the competition was around freebies and big discounts. In fact, we cannot remember the last time Lenskart did not have a buy-one-get-one offer. This particular sales tactic has helped the company build huge brand recall.

Competition caught up eventually, and like Lenskart, rivals have opted for omnichannel sales as well, and many ape Lenskart’s discounting and sales model too.

It’s no secret that the eyewear space in India is highly fragmented, with neighbourhood optical stores enjoying the larger pie as they offer faster service and lower rates. On top of that, the high operating cost of retail, such as rent, employee costs, further reduced Lenskart’s margins and pushed it into the franchise model where it cannot control the full experience.

For an IPO-bound company, Lenskart’s push into smart eyewear or smart glasses is testament to the fact that the company needed a new product lineup to revitalise its product lineup. After all, despite the high TAM for eyewear in India, there’s not much room for innovation, except for design differentiation and pricing.

Incidentally, Urban Company, another IPO-bound startup, is going through a similar shift in search of revenue momentum — transforming from a service company to a product company.

Taking On Tech GiantsThere’s little doubt that the smart glasses category is heating up with even Google launching a specialised version of Android for Extended Reality devices. The tech giant has partnered with eyewear behemoth Warby Parker in the US to launch the first wave of Android XR devices.

Lenskart may face stiff competition from global giants such as Meta’s Ray-Ban glasses, Snap, Apple, Samsung, Xiaomi and others in the future. However, much like in the traditional eyewear segment, Lenskart is expected to compete through aggressive pricing.

Lenskart’s Phonic glasses are a good example of this. The smart glasses start at INR 4,000, which undercuts competing offerings by Bose or JBL.

“They (Lenskart) will be launching these smart glasses at a lower price. Lenskart would want to democratise smart glasses in India,” added one of the sources.

But launching a new product category in a completely different industry has its own challenges. Smart glasses are as much about software as about the glasses themselves.

Lenskart has not exactly shown any evidence of being a software company or one that can maintain reams of code needed to power the smart glasses experience. Are its existing retail outlets capable enough to handle the service needs of smart glasses? Does it have the engineers that can bridge hardware and software for a seamless experience? A lot of questions remain unanswered.

We also don’t know whether this push would require a further capital infusion. The last bit of news around Lenskart was related to Bansal buying back shares in the company at a valuation of close to $7 Bn. Could this be in preparation for a further fundraise in the future?

Early-stage technical flaws can also prove detrimental to customer experience, and end companies before they even begin. In this context, the recent hype and subsequent failure of AI-first devices like the Rabbit R1 or the Humane Pin come to mind.

It’s not easy to become a consumer electronics company, especially for an Indian startup, even one with the scale and the market experience of Lenskart.

With an IPO around the corner, Lenskart has very little margin for error, and it’s making a risky play on AI and smart glasses. How much will this change the company?

Edited By Nikhil Subramaniam

The post Lenskart Adds Smart Glasses To Its Cart: Next Growth Arc Or Risky Bet? appeared first on Inc42 Media.

You may also like

Coldplay scandal: Astronomer CEO's senior recalls bullying episode, says 'hasn't learned his lesson'

Govt not involved in Justice Varma impeachment move; it's a parliamentary matter: Law minister Meghwal

eBay announces huge change to fees - and it will save buyers money

Patna hospital murder: New footage shows gunmen celebrating mafia-style hitjob on streets - Watch

'Magical' coastal town named UK's most popular staycation destination