“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

The observation by American economist Benjamin Graham is more than pertinent for travel tech company EaseMyTrip.

Once a stock market darling with a market cap hovering at around $1.5 Bn (over 12,000 Cr), today many are comparing EMT to a penny stock – a low-value listed company without much upside and too much risk.

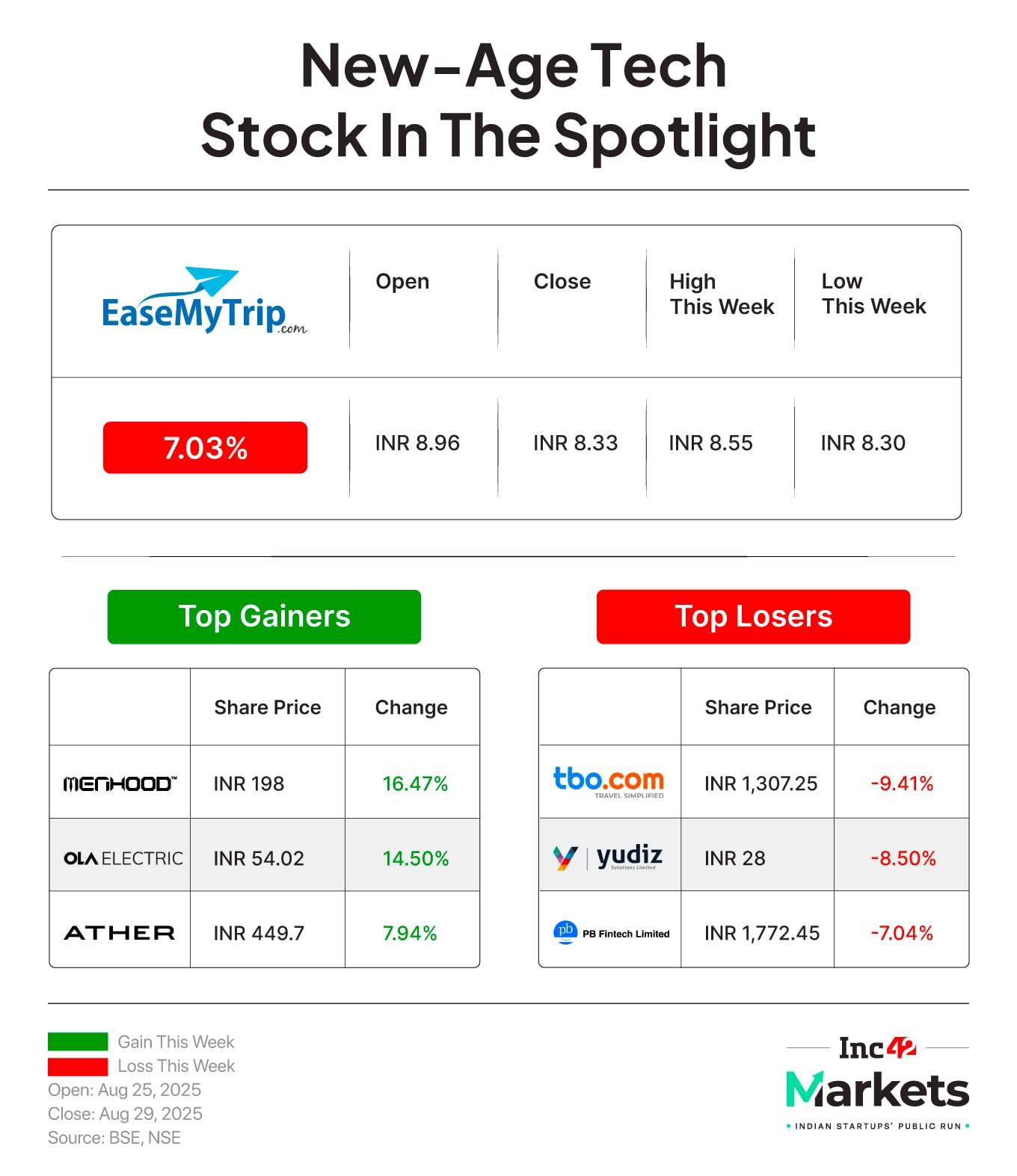

The EaseMyTrip stock has slumped dramatically in the past nine months, shedding close to 50% of its value with the market cap down to a shade above $300 Mn (INR 3,040.41 Cr).

But this decline didn’t come out of the blue and symptoms have been apparent for a while. The market had been reacting to months of slowdown in the core revenue generator (air ticketing), seemingly unplanned experiments and new initiatives as well as corporate governance issues.

Amid EMT’s ongoing rough patch (we’ll delve into this soon), founder Prashant Pitti has now stepped down. Nishant Pitti has taken over as chairman and MD. Two promoters – Nishant and brother Rikant – have decided to forgo their salaries for now, as per the company’s latest disclosures.

But there’s a lot more to be understood. What went wrong with this company that once took pride in its superior corporate governance and frugality?

A Bold Bet And The Fall“Initially, the Pitti brothers built a fantastic business and they could have done a lot better, but it looks like, after a point, they didn’t know what to do with all the money they made at a young age. They kind of lost track,” said an equity analyst, seeking anonymity because of the sensitivity of the matter.

The Pitti brothers earned tremendous credit in the eyes of the market when they built a bootstrapped travel unicorn and took it public amid a pandemic which crippled the travel sector. That was indeed a bold bet, which paid off in the early days.

Rival MakeMyTrip went public on Nasdaq in 2010, but no Indian online travel aggregator (OTA) took the domestic IPO route until EMT hit the Street.

Its robust fundamentals, steady profits, and clear value propositions helped attract investors. The IPO was oversubscribed 160X and the stock debuted at a 13% premium. It rallied six-fold in the next two years.

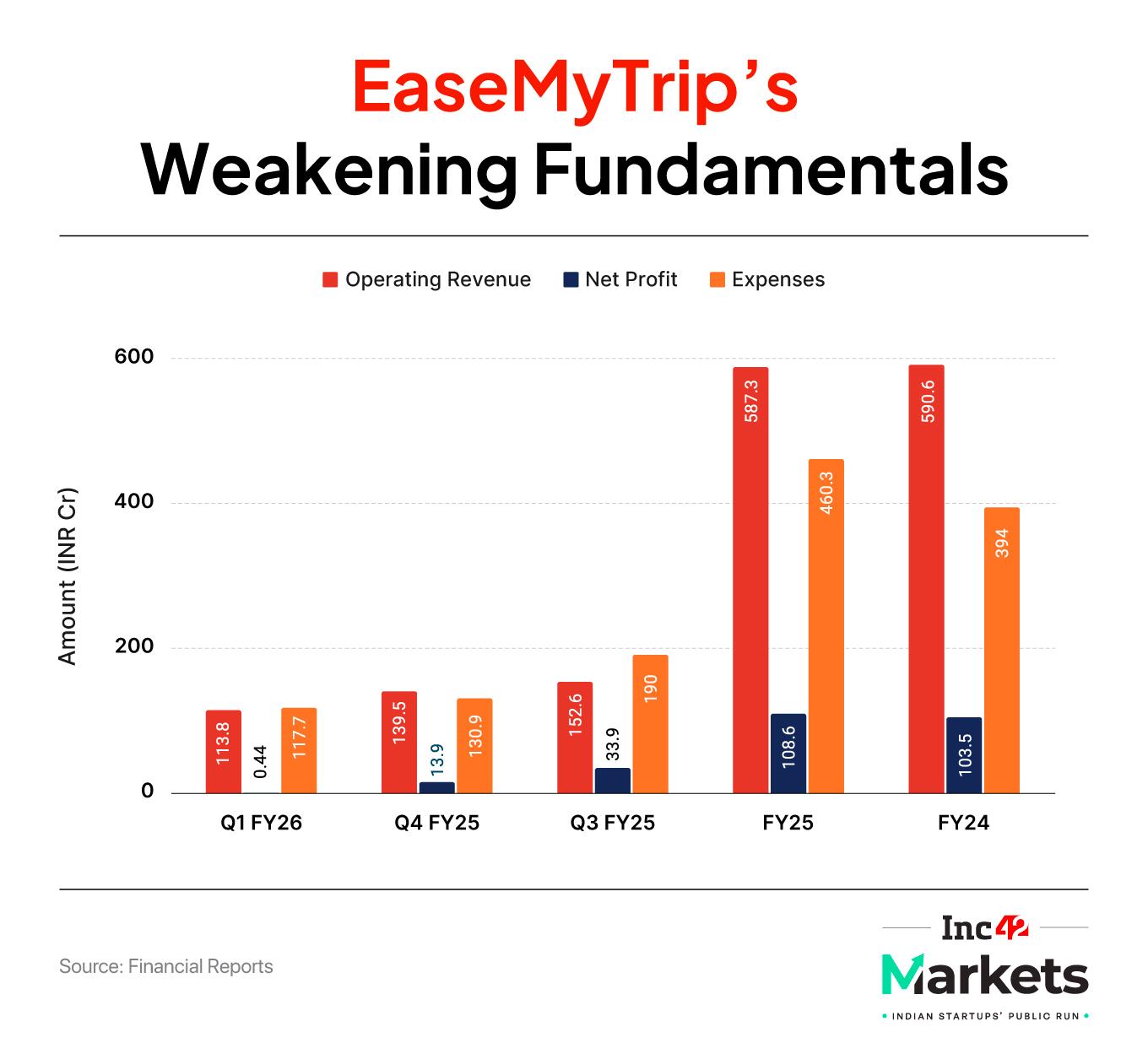

Cut to August 2025. The EMT stock hit an all-time low at INR 8.3 after multiple bonus issues and consistent decline. Worse, in Q1 of FY26, the company’s net profit slumped 99% on-year and 97% on-quarter to INR 44.3 Lakh.

EMT’s core air ticket business recorded a weak quarter, with business sinking over 46% to INR 57 Cr and profit drowning 97% to INR 1.3 Cr. In fact, the business has been in a slump for several quarters, which dented its books, dampened investor interest and dragged the shares down.

“The company is taking steps to optimise its receivables cycle and strengthen collections, with measurable improvements expected in upcoming quarters,” the EMT spokesperson told us.

But the downhill drive has been too steep indeed, compared to the 70% topline growth between FY21 and FY22 and then another 90% surge in FY23. Revenue grew at a meagre 31% in FY24 before falling flat in FY25.

So, was it the so-called revenge travel momentum that triggered the growth in early years? Not quite — EMT had a robust track record of 40% growth in FY20 – a year before the pandemic.

In contrast to EMT’s troubles, rival ixigo saw about a 40% rise in topline to INR 914 Cr in FY25, when its air passage revenue spiked 70% to INR 253 Cr, as against EMT’s 19% plunge in the same vertical to INR 391 Cr.

It must be noted that ixigo’s core vertical is train booking, which brought in 29% growth in revenue from operations, while flight booking surged 149% YoY to surpass INR 103 Cr in Q1 FY26.

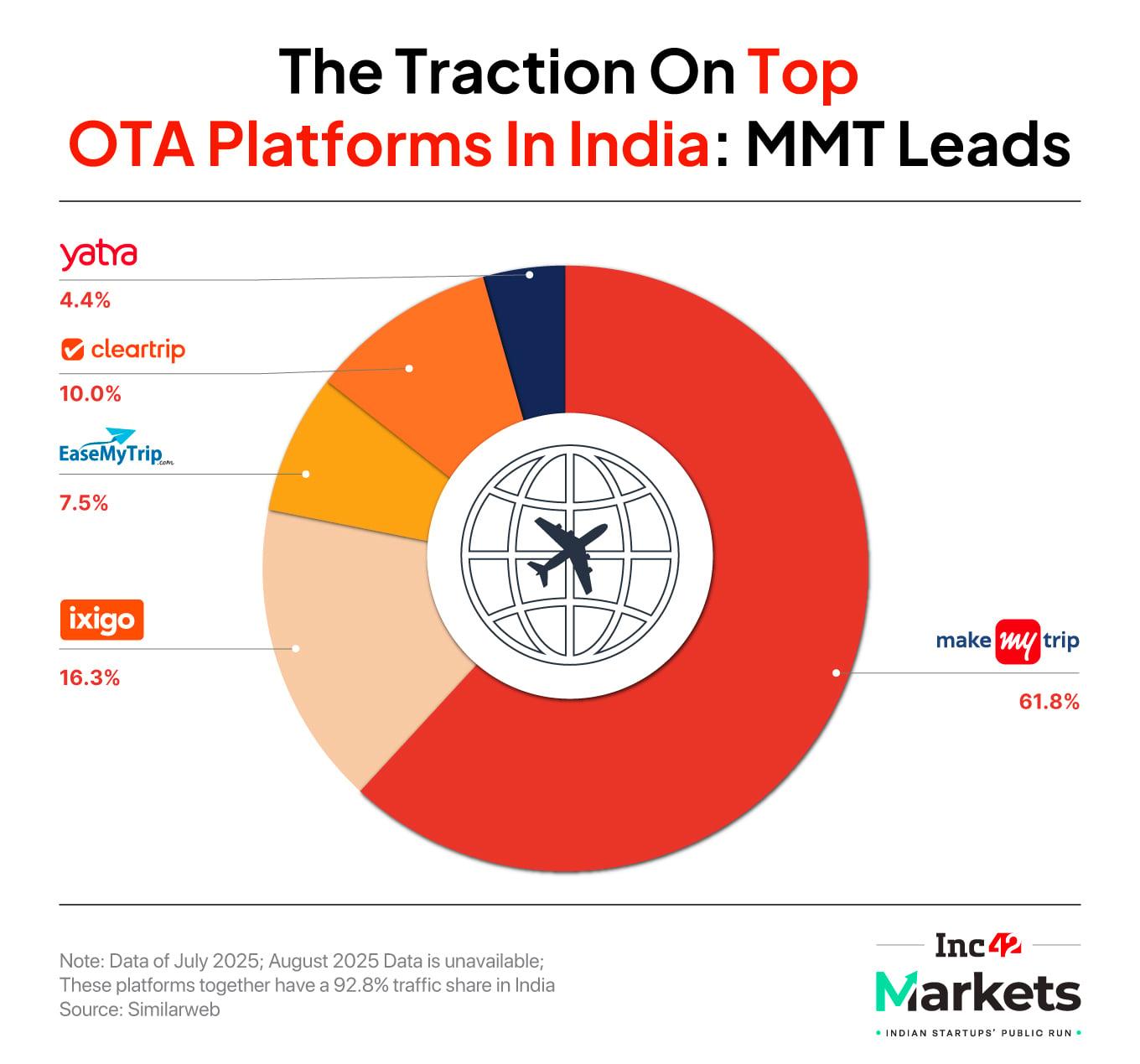

Experts that Inc42 spoke to think that ixigo and Cleartrip are slowly eating up EMT’s market share in the flight booking business and investors are wary of its diversification from OTA to EV manufacturing, venture fund, hotels, and so on.

EMT stays undeterred. A company spokesperson told us it is preparing for its next phase of growth by going deeper into high-margin verticals. The blame for the drop in revenue and profits has largely been laid at the door of changing pricing dynamics and macroeconomic shifts in the air ticketing vertical. EMT says these transitions have hit profit margins in air ticketing significantly.

“Certain OTA players seem to have resorted to short-term measures by issuing heavy discounts, an approach that may not be sustainable in the long run,” the spokesperson added.

Discounts might be one reason why EMT’s share of inquiries and bookings have shrunk, but it’s a strategy that works. As per Similarweb data, EMT had the second-lowest monthly visits in July among the top travel OTAs, with only Yatra performing worse.

In the UAE, another important market for EaseMyTrip, its online traffic lags behind MakeMyTrip and ixigo.

A recent VIDEC report shows EaseMyTrip’s gross bookings share declined to 7.1% in FY24 from 8.2% a year back as MakeMyTrip, Flipkart-backed Cleartrip, and ixigo raced past it.

Other main businesses such as hotel packages, bus and train bookings, too, have either slipped to operating losses or suffered a profit slump despite improved topline in Q1.

“Instead of chasing short-term numbers, we are preparing the company for its next phase of growth. We are penetrating deeper into high-margin verticals by actively scaling in hotels, holidays, and international travel businesses and have taken decisive strategic steps to diversify our offerings,” EMT said, emphasising its vision of building an ecosystem in travel.

Trust Erosion Makes A Deeper CutThis is also why one can’t shake off the feeling that something has changed at the core of EaseMyTrip. Analysts say that the trust of customers, shareholders, and every other stakeholder has eroded greatly, damaging the brand even when the travel industry zoomed.

In 2022, EaseMyTrip announced a bonus share although the stock was rising. Then came a string of acquisitions that increased expenses and shrunk margins. After this, Nishant diverted his funds to team up with cash-strapped SpiceJet (as per media reports) to buy out grounded carrier GoFirst.

The company’s trade receivables surged, while promoters didn’t address concerns related to fundamentals. In fact, the company’s trade receivables doubled to INR 156 Cr in FY24 and reached INR 270 Cr last fiscal. Analysts see this as an unhealthy sign to have around INR 300 Cr in receivables on a topline of INR 400 Cr.

The stock split in September 2024 was another red flag. For companies bleeding market cap, this makes a defensive move to prevent a mass sell-off by investors.

But, nothing could slam the brakes on the tumbling stock. After the split, EaseMyTrip traded at INR 22.15, while it closed at INR 8.3 on August 28, losing over 60% in value.

The association of EaseMyTrip’s founders to the ED investigation into the Mahadev betting app scam is another reason why some investors may have become spooked. However, the company has denied any links to the betting app.

What’s Ahead For EaseMyTrip?The road ahead is foggy, feel observers, with the company not slowing down in terms of experiments and new initiatives. This makes it hard to track EMT’s trajectory, since it’s unclear how much revenue its new ‘projects’ are generating.

First it launched an insurance broking subsidiary, then set up a five-star hotel in Ayodhya, and then entered electric bus manufacturing through a subsidiary.

Most recently, it announced EaseMyTrip 2.0, which is a strategic initiative to expand its presence across the broader travel and lifestyle ecosystem. As per plans, it will invest and acquire partial stakes in companies while letting the founders maintain full operational control.

In June, the company announced the launch of EMT Invest, a strategic investment arm for picking up minority stakes in profitable, founder-led businesses.

Naturally, this has raised such questions as: is the company becoming an investment firm or a house of brands for travel?

Atul Thakkar, investment banking director at Anand Rathi Investment Banking, told Inc42 that the biggest problem with EaseMyTrip is that its promoters have started looking at other ventures. “The company had a lot of corporate clients, and they got to know these issues. If your focus shifts, your clients will have a problem.”

The company, however, maintains that it remains firmly positioned as an online travel platform. Further, the EMT spokesperson claimed that acquisitions and investments in high-potential verticals such as holidays, hotels, sustainable transport, and even medical tourism are designed to diversify revenue streams and reduce dependence on a single segment.

Our new initiatives in hospitality and electric mobility are strategic vertical expansion in the travel ecosystem, not a pivot. Initiatives such as EMT Invest and other strategic ventures are designed to complement the core business of air travel, enhance customer lifetime value, and create long-term shareholder returns,” the spokesperson added in response to Inc42’s questions on the new initiatives.

The crisis has put off brokerages so much that they have stopped covering EMT for their clients. Instead, they question Nishant’s stake sale and other moves. Prashant, too, liquidated part of his holding to set up lending tech platform Optimo Loan last year. Nishant pledged more shares to raise funds for his “personal use” in July.

EMT is putting up a brave face in the light of these challenges. “Our growth story is intact, our fundamentals are strong,” the spokesperson said. However, these corporate governance issues will make it a bit harder for EaseMyTrip to bounce back.

The promoters now hold below 50% in the company and mutual funds have lowered their exposure. Today, analysts believe that the stock will continue to trade at its current low price with recovery not in sight in the short term.

Rupak De, senior technical analyst at LKP Securities, predicts a further slump in EaseMyTrip shares. He suggests investors to ‘hold’ the stock at a stop-loss of INR 8.28 and expects a recovery in the long run only if it doesn’t breach the current stop-loss level.

But, business remains the bigger issue. Will the company resolve these governance issues and actually get back to earning revenue again?

While much has gone wrong, it wouldn’t be wrong to bet on EMT’s founders, who built a strong business without any VC support, to make a comeback. However, it won’t be easy in the current intensely competitive market.

Markets Watch: New Listings, Deals & More- Jio’s IPO Plan: The much-awaited IPO of Reliance’s Jio was announced this week, as it plans for a public listing by H1 2026

- Leap Floats Its DRHP: The supply chain solutions provider filed its draft papers with the Securities and Exchange Board of India (SEBI) to raise up to INR 2,400 Cr via its IPO

- Elevation Capital’s Public Market Bet: The VC firm launched a new late-stage fund, Elevation Holdings, with a corpus of $400 Mn to back startups going public

- Prosus To Fuel Rapido: Reports this week hinted at Prosus planning to invest an additional $200 Mn in the ride-hailing major

- Miko Raising Funds: YourNest, Chiratae-backed robotics startup Miko received board approval to raise $151 Mn from AMDG-PAX Foundation as part of Series D

The post EaseMyTrip’s Wrong Turn appeared first on Inc42 Media.

You may also like

Direct flight between India and China, Mansarovar Yatra, peace on the border... these issues were discussed between PM Modi and Xi Jinping

Newcastle identify third target to replace Alexander Isak after Liverpool transfer agreement

Kolo Muani move, Lookman hijack - Tottenham's best and worst case transfer deadline day scenarios

Monsoon fury batters Pakistan, Khyber Pakhtunkhwa worst hit

Jeremy Clarkson issues four-word Kimi Antonelli defence after Jacques Villeneuve attack